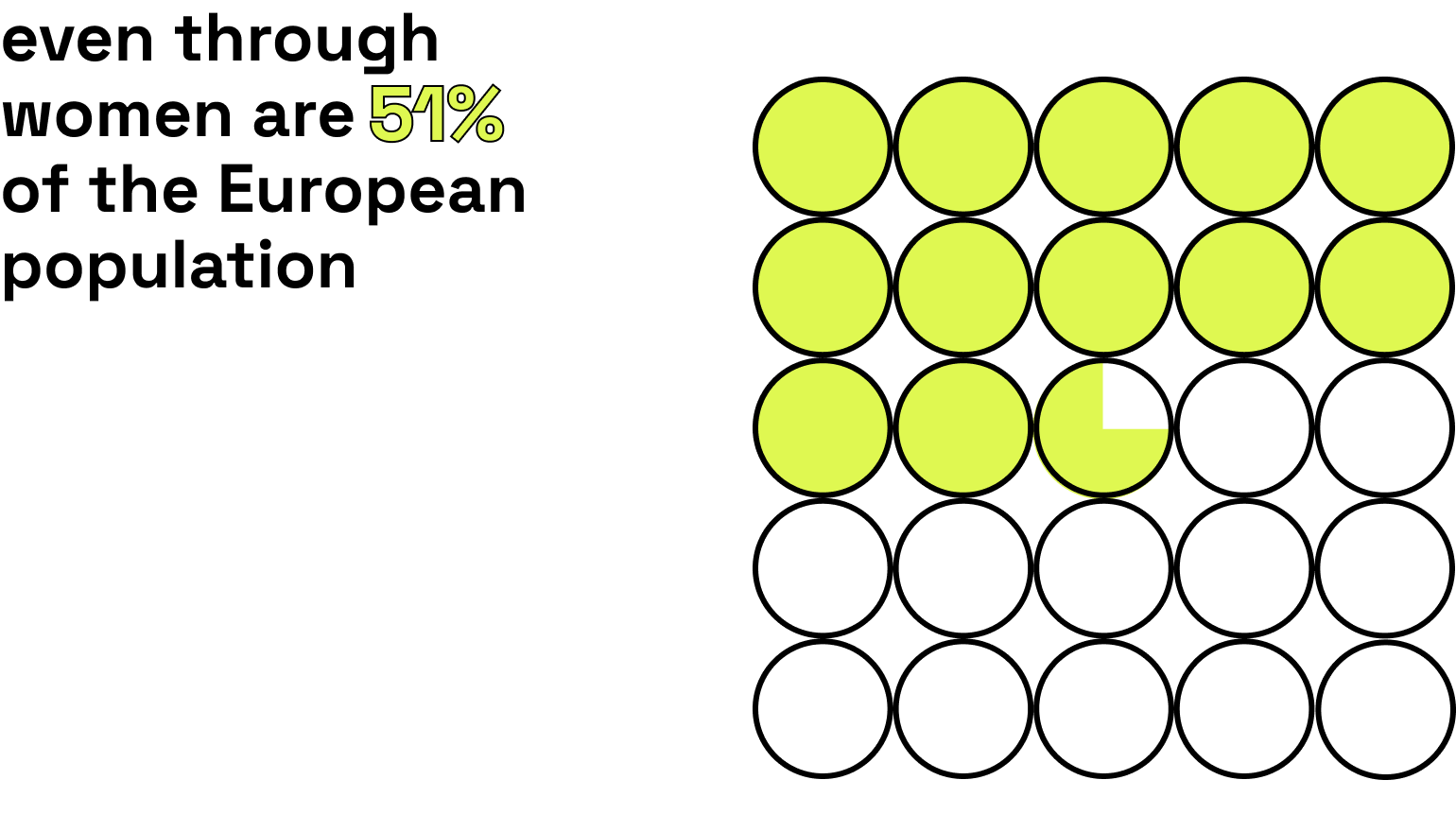

At Google, when we think about a problem, we always start by looking at the data. When you look at

the

data regarding

progress for women and particularly for women of colour, a clear pattern emerges: We’ve made

progress,

but it’s been

uneven, frustratingly slow, and equality is a long way off.

Looking back on the last few decades we’ve seen some progress realized. To start with, more girls are

going to school

than ever before, and increasing women’s and girls’ education contributes both to their empowerment

and

accounts for 50%

of the economic growth in OECD countries over the past 50 years. Plus, not only are women in the

workforce more than

ever before, they’re also getting paid more. 50 years ago, women made 60 cents for every dollar a

man

made. Today,

thankfully that gap has shrunk - yet as the report states, a white woman still only makes around 78

cents to a white

man’s dollar, and for women and men of colour, it’s even less.

So it’s meaningful progress - but it’s not enough. And these improvements are fragile, as recent

crises

have shown. For

example, globally, women were almost twice as likely to lose their jobs as a result of COVID-19.

There is also a new urgency. We are facing a plethora of challenges globally and in Europe - from

climate, to energy

security, to the rising cost of living and inequality. Not only will women and women of colour face

the

brunt of these

crises, but they are being held back in being able to effectively respond to them. We need to take

action now.

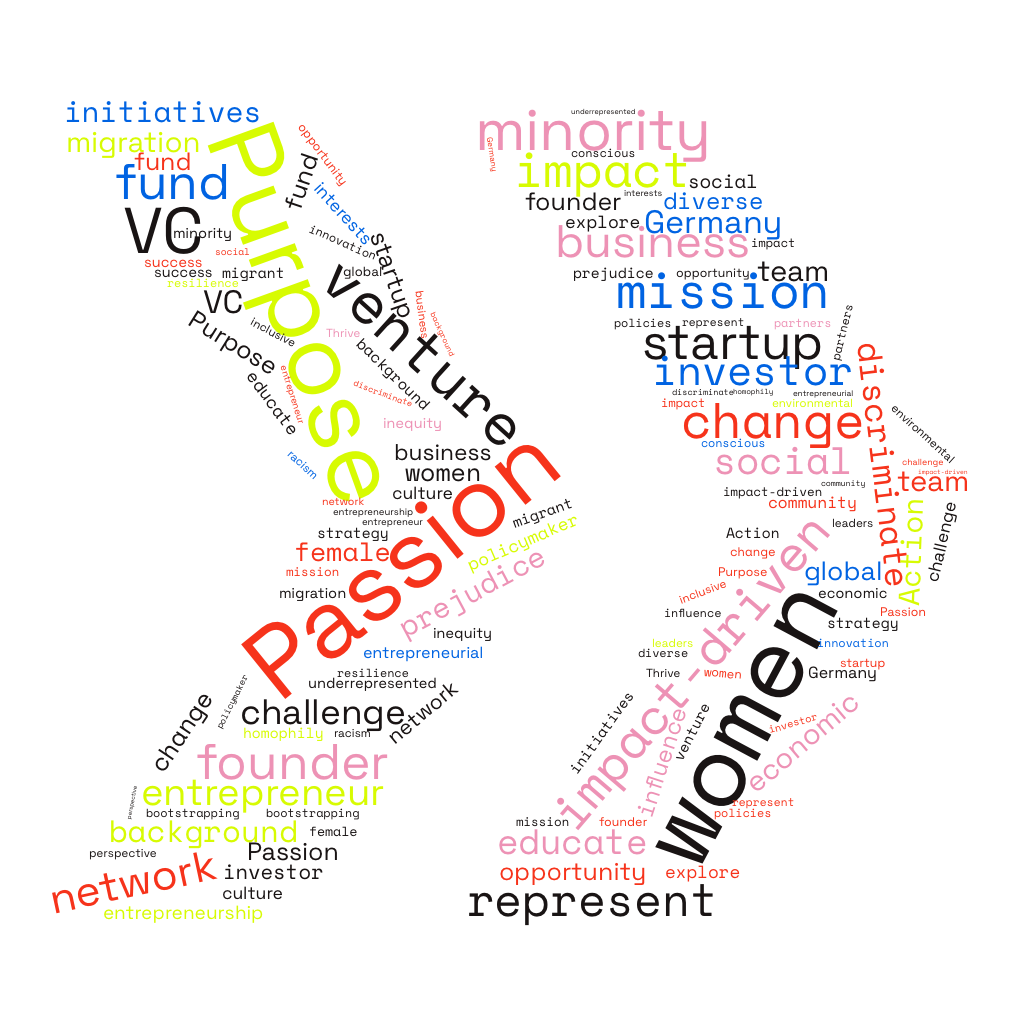

In practice, this means we need two critical things. Firstly, we need socially-minded entrepreneurs

-

who are putting

people, purpose and the planet at the centre of business goals. Second, we need to support people

from

underserved

communities to be successful entrepreneurs - and come up with the solutions. Because if there is one

thing we’ve learnt

from our work at Google.org - it’s that it’s those that are closest to the problem that will come up

with the most

effective solution to it.

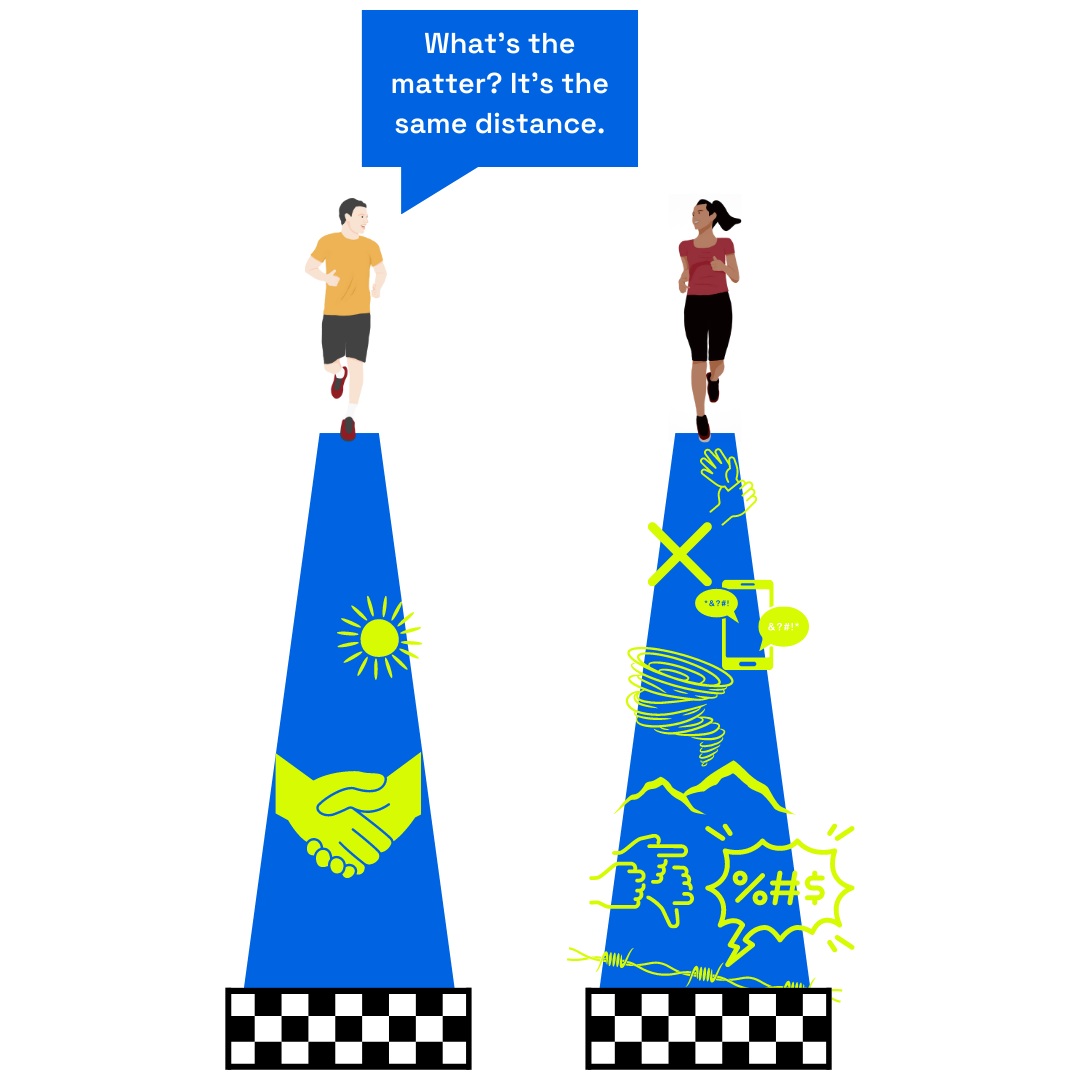

The data is clear that organisations with a woman in the founding team are more successful. And

founders

who are women

of colour tend also to be impact-driven, with research showing that they create businesses that

solve

problems that they

and their communities are confronted with. And yet as this report clearly shows, these founders

continue

to face a

multitude of barriers and aren’t getting the investment they need to build businesses that can

change

the world for the

better.

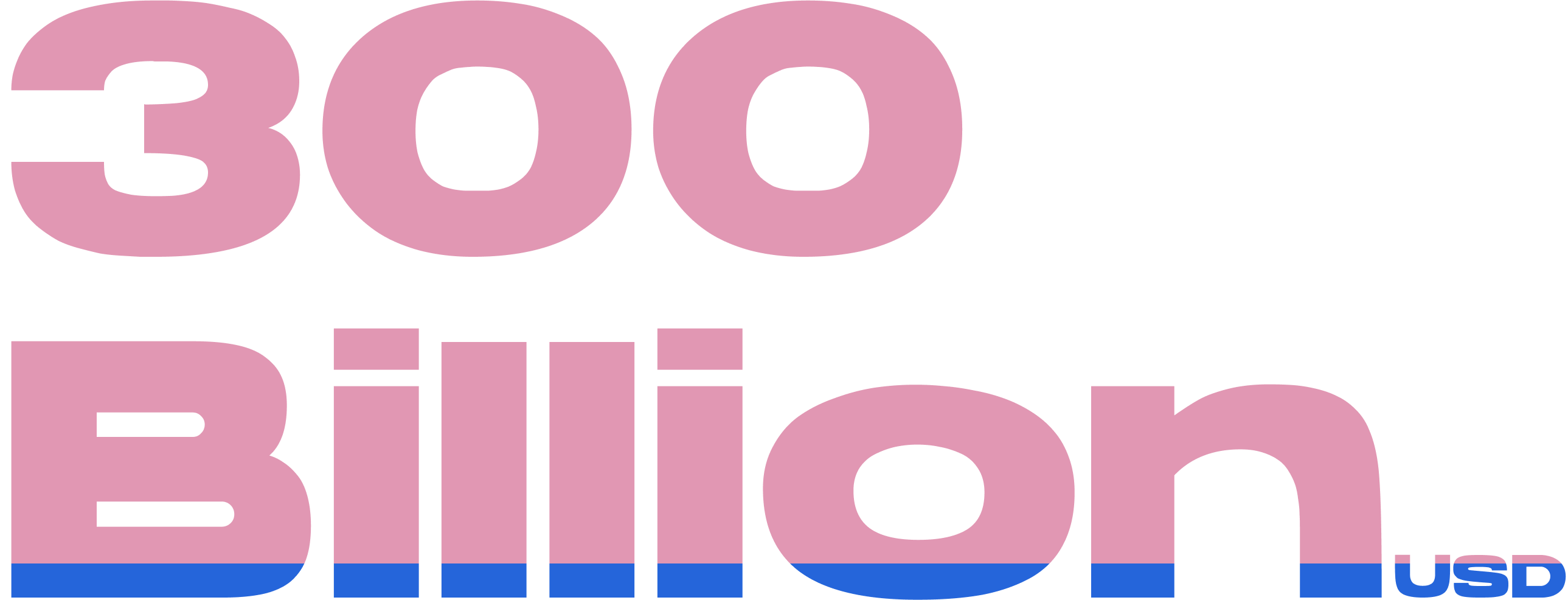

It’s a huge missed opportunity - one that hinders innovation and limits opportunities for economic

opportunity, wealth

generation and upward mobility and equity for women of colour. And, investors are also missing out

on

new business

opportunities for return, while being able to make a positive difference.

Clearly therefore, we need to do far more to unlock investment in the organisations that women of

colour

build, both in

support of critical ecosystem-strengthening organisations like Founderland, as well as investment in

the

founders

themselves. Our Women & Girls Impact Challenge, of which Founderland was a grantee, was one of our

most

popular

programmes ever, with thousands of organisations applying. We know that there are groups out there,

ready to make a

difference, they just need the funding and expertise to make their ideas a reality.

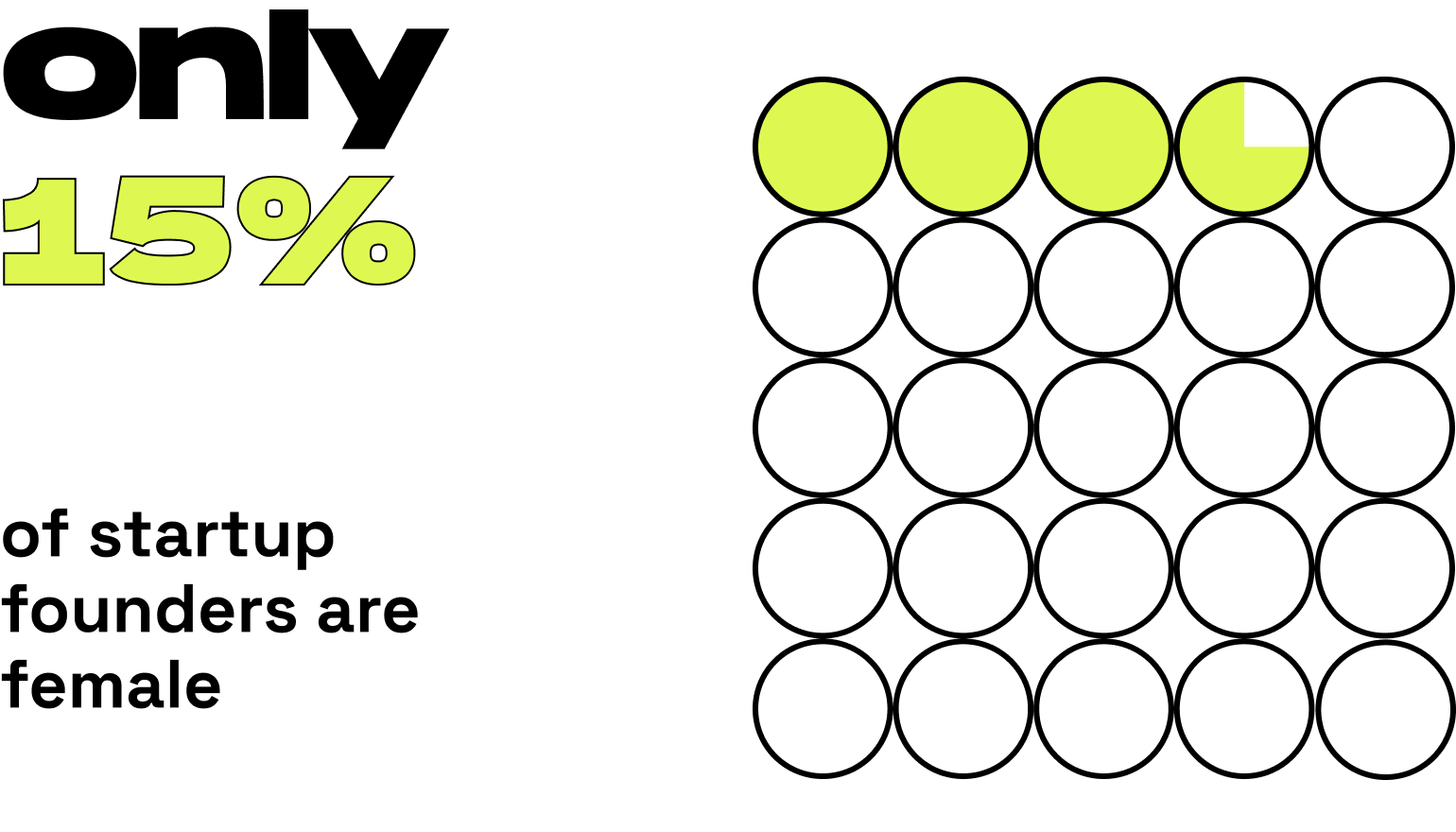

Some people may argue that there is already a plethora of DEI initiatives and accelerators and

programs

for female

founders. Well, compared to 10 or 20 years ago yes, but we’re far from having solved the issue and

the

number of women

participating pales compared to male participation in similar programs. And critically, while

support

programs are very

important, investment is the number one need. Women of colour tend to report being over-mentored and

under-funded -

without funding, a great idea remains an idea.

We therefore need to look closer to home - at ourselves, as funders, investors and philanthropists.

If

you are a funder

- and particularly a white male - the first step is to recognise your own privilege and bias, the

second

is to educate

yourself, and the third is to take action. By reading this, you are already on step two. Step three

is

the harder one.

So take a moment once you have read this report and ask yourself, what can you do, and what are you

willing to do, to

make a positive difference to support women, and particularly women of colour entrepreneurs, to help

make our world a

better place by building great ventures.

Rowan Barnett - Director, Google.org - Europe, Middle East & Africa

Nicole Danna - Impact Challenge Lead, Google.org